The Future of the Oil Industry: Part 2

THE FUTURE OF THE OIL INDUSTRY

PART 2: The Hubbert Peak

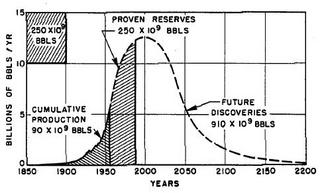

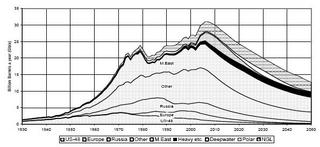

Renewable energy sources are those that can be replenished naturally in a short period of time and, as we’ve seen before, petroleum would need millions of years to form. This is why we call it a non-renewable resource: one that cannot be replaced once it is consumed. If this is true then the most important question that we should be making is when are we going to run out of it? In 1956 a Shell geologist, M. King Hubbert, presented a paper at a meeting of the American Petroleum Institute proposing that the total amount of extracted oil over time would follow a logistic curve. According to this curve, once we have extracted half of the total available oil we would reach its peak (known as the Hubbert Peak or the Peak Oil) and, after that, production will inevitably decline.

Hubbert predicted that the oil production in the continental USA would peak between 1965 and 1970, prediction that was proven true after 1971, for production in the USA has been decreasing since then. It’s said that if the politically created oil shocks of the 1970s hadn’t happened, Hubbert’s prediction that the world’s petroleum production would peak by 2000 would have been also proven correct. Many scientists believe that the world’s peak oil has been delayed for about 10 years, and this would mean that we’re about to reach that time.

So, when are we running out if it?

As Life After the Oil Crash puts it: the issue is not one of "running out" so much as it is not having enough to keep our economy running. In this regard, the ramifications of Peak Oil for our civilization are similar to the ramifications of dehydration for the human body. The human body is 70 percent water. The body of a 200 pound man thus holds 140 pounds of water. Because water is so crucial to everything the human body does, the man doesn't need to lose all 140 pounds of water weight before collapsing due to dehydration. A loss of as little as 10-15 pounds of water may be enough to kill him.

If we consider additionally that the world’s population is growing exponentially and that our industrialized world employs more energy than before (see Part 1), we can see that if we reach the point in which the shortfall between demand and supply is as little as 10-15 percent, we could face serious economical impacts.

So, when are we reaching the Peak Oil Point? The Association for the Study of Peak Oil and Gas estimates that it will be reached by year 2008.

Petroleum companies, even though claim publicly that we are very far from the Peak Oil, have started trying to secure as much global reserves as they can:

- December 1998: BP and Amoco merge

- April 1999: BP-Amoco and Arco agree to merge

- December 1999: Exxon and Mobil merge

- October 2000: Chevron and Texaco agree to merge

- November 2001: Phillips and Conoco agree to merge

- September 2002: Shell acquires Penzoil-Quaker State

- February 2003: Frontier Oil and Holly agree to merge

- March 2004: Marathon acquires 40% of Ashland

- April 2004: Westport Resources acquires Kerr-McGee

- April 2005: Chevron-Texaco and Unocal merge

- June 2005: Royal Dutch and Shell merge

- July 2005: China begins trying to acquire Unocal

What would be the consequences of the Peak Oil?

If we cross the Peak Oil, we would face a serious oil shortage, which effects will depend on the rate of decline and the development and adoption of alternatives. If no alternatives are developed, we would not be able to satisfy our energy needs, which in turn would lower our living standards. Scenarios range from doomsday scenarios to faith in the market economy and new technologies to solve the problem but, in any case, petroleum will be a scarce resource and then its price it’s going to rise.

I thought petroleum companies were pushing prices up…

Yes, it’s a common view. Of course, the fact that petroleum companies are among the most profitable businesses in the world doesn’t help. But they’re actually rich because the price of the petroleum is rising, and it’s not the other way around. Let’s put it this way: petroleum is the most important energy source that we have today, but there are many others who would love to occupy its place. If petroleum prices rise too much, the other energy sources will become cheap in comparison, and could take a piece of the pie. And, believe me: Oil Companies don’t want to share a single crumb of the pie!

The problem is that petroleum prices have escaped from their control. The world is consuming more and more oil, and Oil Companies are producing at almost their maximum capacities. The fact that they’re not able to put more petroleum on the market (controlling its price) is clear evidence that we may be reaching the Peak Oil…

In Part 3 we’re going to see the different scenarios for the world in case we’re reaching the Peak Oil.

See you here back soon!

___________________________________________

Some of the data mentioned here was obtained from the following sources, and you’re invited to visit their pages:

- Wikipedia (Hubbert Curve)

- Wolf at the Door

- Hubbert Peak of Oil Production

- Life After the Oil Crash

- Association for the Study of Peak Oil and Gas

- San Francisco Chronicle

3 Comments:

Very interesting read.

All through time we see that civilizations come and go.

It's crazy how we have built our civilization on a substance that will run out.

I remember my Commerce teacher telling us by the late 1980's petrol would be almost all gone.

By Odge, at 5:08 PM

Odge, at 5:08 PM

Really good article; I never think in such things in maths way. Of course there is more people every year, more industry and less production. but, the first time I see in a maths way.

By x1, at 8:38 PM

x1, at 8:38 PM

urgh... i am tired.. and need to read this article.. too heavy

informative post though

By Eddie, at 10:06 PM

Eddie, at 10:06 PM

Post a Comment

<< Home